The Do’s and Don’ts of Credit Cards

If you have decided to use your credit cards despite having heard and read about all of the negatives, then good for you. Just remember that moderation and awareness are the keys.

If you have decided to use your credit cards despite having heard and read about all of the negatives, then good for you. Just remember that moderation and awareness are the keys.

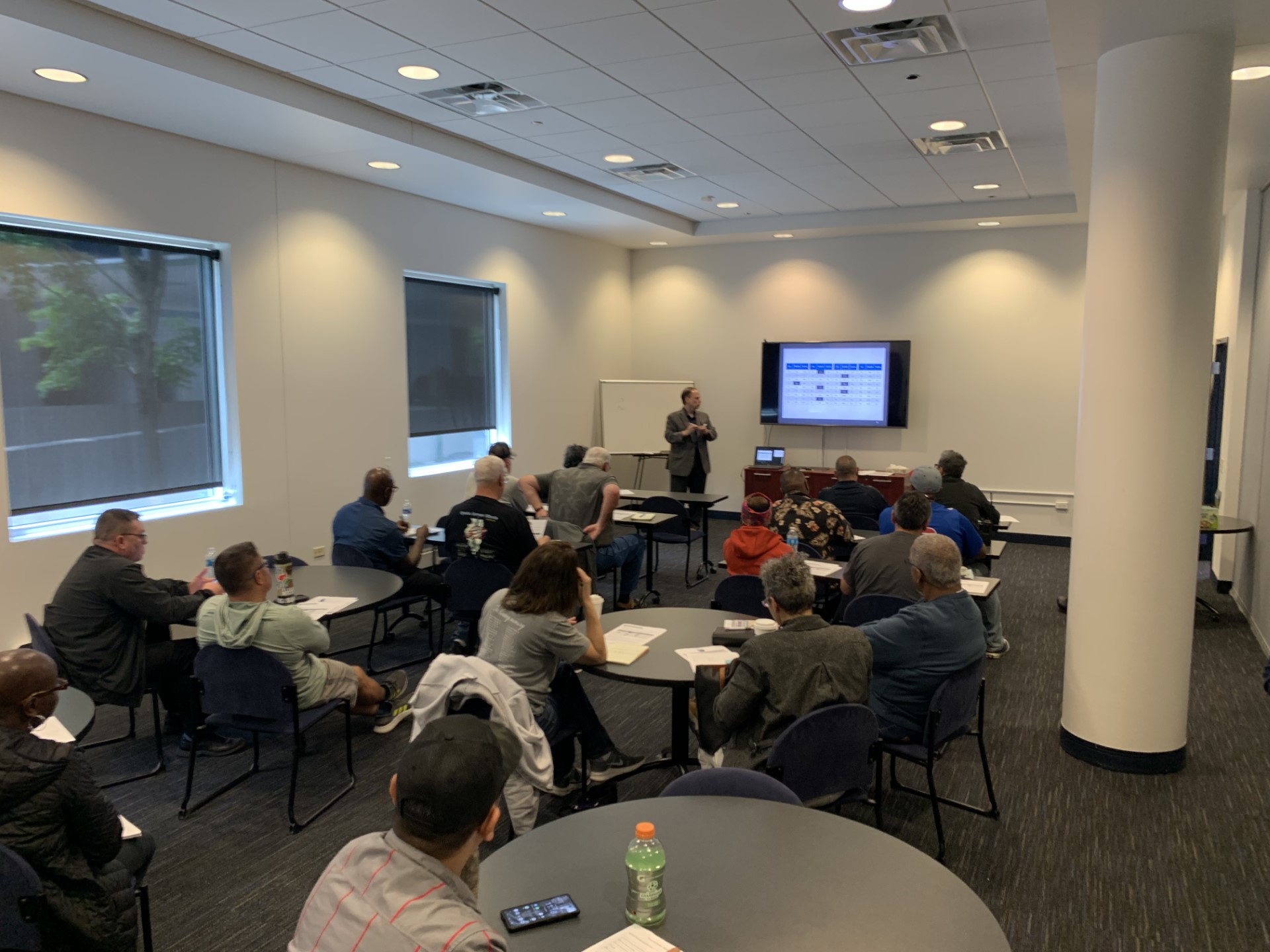

Thank you to everyone who attended yesterday’s Financial Fitness for First Responders’ Seminar, “Are You Living Your Best

The Credit Union was honored to attend the May 1st Missouri Police Chiefs Association’s Annual Conference in Osage

National Police Credit Union Division President Jim Bedinger was honored to be a featured guest on the Proud Police Wife Podcast with Rebecca Lynn, who hosts honest and real conversations, topics and advice for families in Law Enforcement.

It is possible to meet your needs and achieve your wants, but only if you first separate them and then apply the reality of your finances to the equation.

At this point, you have completed all of the steps and have clearly learned how to make good, sound financial decisions. You are following your own path and realizing power and command that previously seemed unreachable.

As a Law Enforcement Officer or family member, are you a member of a Law Enforcement credit union? If not, you should be! There are several reasons why.

Dealing with your own mortality can be difficult and overwhelming. So much so, that often times you may choose not to think about it at all.

If you think that you can realistically hit these targets, it may seem like the remaining 62% of your net income is yours to do what you want with, but don’t forget about the other expenses not already included in your loan payment calculation. Insurance costs, utility bills, and groceries add up and are probably more costly than you think especially if you have never itemized them before.

In previous articles, we have outlined the steps that you can take to improve both your understanding and the quality of your financial situation. No step, however, is more important than the one that involves your willingness to communicate with your spouse, trusted friend/mentor, and/or financial advisor.

10343 S. Pulaski Rd.

Chicago, IL 60655

Lobby: Mon-Fri 8:00AM-5:00 PM

Drive Up: Mon-Fri 8:00AM-5:00 PM

Safe Deposit: Mon-Fri 8:00AM-4:30 PM

Coin Machine: Mon-Fri 8:00AM-4:30 PM

5310 N. Harlem Ave.

Chicago, IL 60656

Lobby: Mon-Fri 8:00AM-5:00 PM

Drive Up: Mon-Fri 8:00AM-5:00 PM

Safe Deposit: Mon-Fri 8:00AM-4:30 PM

Coin Machine: Mon-Fri 8:00AM-4:30 PM

1810 Buchholzer Blvd,

Akron, OH 44310

Lobby: Mon-Fri 8:00AM-4:00 PM